Sabtu, 18 Januari 2014

Introduction

A number of changes have taken place in local government during the past twenty years that have changed the way internal audit operates and manages its activities. Legislation has played an important role in these changes, but other factors such as the information technology explosion and environmental awareness have also had an impact on the development of internal audit. Coupled with these changes, the expectations of stakeholders in the public purse have become more pronounced as well as audit’s own perception of itself. It is these changes and their influence on internal audit methodology and approach that this paper looks at in terms of their impact on and response by internal auditors within the Welsh local government sector. The personal aspirations, fears, expectations of those in the front line of these changes can provide an interesting comparison with the internal audit theory and textbook ideas on the development of internal audit.

There is no doubt that internal audit as a function within local government has increased in profile during the past decade. This is mainly due to increased pressures placed on public sector organisations due to the restrictions on funds and the need to ensure good value for money exists within local government. It could be argued that in the main it is the external auditor that taken the limelight and the credit for ensuring more accountability, but in recent years thanks to reports relating to corporate governance the role and importance of the internal auditor has gradually been coming to the forefront. This is reinforced by the Turnbull report on corporate governance which has helped identify the relevance of having a sound control structure that is complimented by the presence of an internal audit body.

On a more practical base the professional bodies have revamped their professional training programmes, and advanced training programmes have been introduced to meet the changing nature of auditing thereby equipping the auditor with the relevant tools for the work place.

Research area

This research paper focuses on practitioner views and responses to changes in audit approach and audit development resulting from influences placed upon it by bothinternal and external factors. When designing the questionnaire for the research, a review of textbooks and journals to identify current issues in auditing, prophesies about where auditing is heading and the problems facing the auditor provided the core material. Leading on from this initial review, a pilot study questionnaire on the views of a select number of internal auditors within local government as to how they perceive these changes affect their working methods, their expectations, aspirations, and perceptions provided the practitioner input. This feedback combined with the literature research provided a set of topical issues from which to generate a series of statements and questions.

As Jankowicz (1995) points out ‘knowledge does not exist in a vacuum, and your work only has value in relation to other people’s. Your work and your findings will be significant only to the extent that they’re the same as, or different from other people’s work and findings’. While Gill and Johnson (1991) state that what is required is a ‘critical review which demonstrates some awareness of the current state of knowledge on the subject, its limitations, and how the proposed research aims to add what is known’. These two statements rang true when the survey results were analysed, as the outcomes were not particularly dramatic or revolutionary, yet they generally confirmed current views and opinions.Articles written by auditing practitioners and academics in professional journals such as Internal Auditing, Public Finance, Managerial Auditing, Public Money and Management provided the state of the art thinking in terms of recent and topical issues affecting the auditing profession. ‘A number of articles are written from the academic perspective and therefore by their very nature provide the ideal source from which to compare, they also provide a base from which to design questions for the survey.’ Nash (1996). Very often prior to undertaking any research, the researcher will have some perceived expectations as to the reasons and possible outcome of the research, a literature review forms a means by which to either confirm or dismiss these preconceived

expectations. As examples, articles written by Ridley (1999) and Lower (1999) provide current thinking on the ‘new audit’ and the skills auditors should posses in order to face the challenges of the 21st century.

Welsh local government auditors

The involvement of the Welsh local government internal auditors stemmed from two aspects, Wales having just created its own National Assembly made it an entity on its own, and interest shown by the Welsh Chief Auditors Group created a ready made captive audience that would participate in the survey. The research findings provided a base for the preparation of the analysis and also provided a summary for the Chief Auditors Group of key results and issues that they could use as seminar topic and a feedback mechanism for practitioners to learn from each other. Participants in this survey came from a cross-section of auditors working in local government from all the 22 Welsh unitary authorities.

Internal audit definitions

In order to appreciate the role and responsibilities of internal auditing, it is worth noting the changes in definitions to reflect the changing role, responsibilities and activities. By identifying the changing role of internal audit it forms a base for surveying how the internal auditor views these changes in light of practical experiences working in the public sector. Current definitions for internal audit imply that the role of the internal auditor has moved on from that of an appraisal, monitoring and evaluating function, to that of a provider of assurance, consultancy, assistance and advice.

In January 2000 the Institute of Internal Auditors published a new definition of internal auditing that reads:

‘Internal Auditing is an independent, objective, assurance and consulting activity designed to add value and improve an organisation’s operations. It helps an organisation accomplish its objectives by bringing a systematic, disciplined approach to evaluate and improve effectiveness of risk management, control, and governance process’.

The Auditing Practices Board Auditing Guidelines offers the following:

‘An independent appraisal function established by the management of an organisation for the review of the internal control system as a service to the organisation. It objectively examines, evaluates and reports on the adequacy of internal control as a contribution to the proper, economic, efficient, and effective use of resources.’

These definitions provided a source of questions such as:

Does the auditor feel that he is actually providing a worthwhile service in terms of being a valued member of the organisation?

Does the auditor contribute to effective management of resources? and

Does the auditor still only undertake the traditional role of evaluating control structures?

As for identifying the expected in terms of the audit, traditional teaching texts, such as Millichamp, Lee, Woolfe, and Manson and Gray provided the audit approach methodology and provided a sound base from which to compare the research findings to the ‘expected’ audit developments.

Questionnaire format

The questionnaire was primarily made up of statements requiring the respondent to opt for one answer out of five using the Likert format of questionnaire design requiring the respondents to decide between a varying degree of agreement to disagreement.

Respondents were encouraged to put comments alongside the statements if they felt that some of the issues raised required further explanation on their part.

The statements were categorised into six key areas:

- Client and auditor expectations/perceptions

- Training and its application

- Corporate Governance

- Control Risk Self Assessment

- IT use in audit work

- Audit approach - Systems Based Audit Risk Based Audit.

Summarising the responses

A summary of the responses according to the majority view was recorded on a template of the questionnaire to identify areas that confirmed or disagreed with the statements. Each topic area of the questionnaire was subdivided into sections in order to ease data review and comparison against the literature review findings. Appendix 1 is a copy of the statements used in the questionnaire along with summarised overall responses categorised according to the most favoured response.

Analysis of respondents

In order to aid in the classification and comparison the questionnaire had a section to identify between levels of experience, length of service, and qualifications of the respondents. The survey was designed to give a broad view of internal auditor views on a selection of topics, hence the diversity of the topic areas.

Table 1 below gives a breakdown of the respondents surveyed according to officer designations.

Table 1: Breakdown according to designation

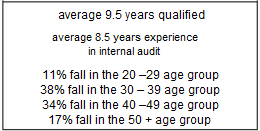

In addition to the officer grade an analysis of participant according to professional qualification, number of years experience in audit and age group was also extracted from the survey result.

Table 2 details the profile in terms of qualification, experience in auditing and age group.

Table 2: Qualification, experience in internal audit and age profile

Synthesis of survey results

The questionnaire survey confirmed some of the preconceived views that existed prior to the distribution of the questionnaire, in that generally audit may be facing numerous changes, but basically it still has its strong internal control roots. ‘Internal audit should not miss the chance to prove that it can be a dynamic resource, able to give effective challenge and assurance to contribute to continuous improvement while keeping its feet firmly on the ground of internal control.’ Clackett (2000).

From the six topics that were considered in the survey, certain key issues from the analysed questionnaire statements emerged that are worth noting. Some fall into the ‘agreement with’, ‘differences to’ and ‘variations from ’ the original preconceived views derived from the literature search. It is these research findings and observations that are discussed in this paper.

Key issues identified

From the questionnaire summarised survey of results certain statements reflect more than others the internal audit expectations, attitudes and perceptions. These have been highlighted below with additional remarks added as explanations and interpretations.

The key issues that emerge from this survey are summarised in italics below and commented upon accordingly.

Internal auditors recognise the fact that the expectations from managers indicate that they are looking for more than a routine audit from the audit sections and look to audit for some level of assurance and advice.

This reflects the current internal audit definitions and agrees that the audit is becoming more of a service to management in terms of assurances, than merely the regulatory and probity audit of past years and does reflect the fact that audit is responding to the demands of the client.

Auditors are unsure as to whether their profile is very high.

The view from the auditors here is that despite what may be written about the increased profile that corporate governance may have given internal audit, there is still a feeling of uncertainty regarding the profile. This does depend on the individual authority and the relationship between the management and the audit. And it also depends on how the audit is perceived by management. 40% of the respondents were unsure as to whether the audit profile was high or not. One respondent commented that ‘hopefully with the increased level of auditor client consultation this will alter’. An issue that could be explored here is whether the lack of profile is due to the low level of marketing undertaken by the audit function within the individual authority and not the audit service itself.

The survey showed that 28% agreed that auditors are not regarded as a nuisance, however 53% disagreed and felt that they were regarded as an inconvenience. This could therefore be interpreted that auditors feel they are either generally accepted and respected or possibly merely tolerated. The responses for this statement were analysed according to seniority and those in agreement represented an equal number of CIA, principal, senior and trainee auditors. For those disagreeing the majority were principal auditors.

There was an agreement that client attitude towards the auditor had improved, and according to a few of the respondents they felt that building a good client relationships was a continuing process especially where audit staff made presentations to departmental mangers about the audit task, duties and service. Some felt that the audit effort to enhance a better understanding of audit was paying dividends. 76% of internal auditors agreed that mangers could change their view on audit with a change in audit approach. This may be a generalisation, but there is scope here to develop further how an altered audit approach could encourage a changed view of audit by management. This is borne out by Jones, Anne Marie (2000), ‘Internal auditors need to be more active in marketing the true value that internal audit can add to a business. We must not underestimate how much influence we can have in an organisation - from its day-to-day working practices to its strategic management direction. But we must work with the organisation to achieve this and be seen to share in the organisation’s aim and objectives’.

Respondents failed to agree whether the audit work meets with client needs.

There was a 65 / 35 split on whether the audit work undertaken met the client needs as opposed to audit requirements.‘Management do not take advantage of the opportunity to contribute and input to the audit planning process’ according to one respondent. Client consultation seems to exist nevertheless, as the overall view disagreed with the ‘insufficient consultation’ statement. Comments from the participants however indicate that the audit teams, as opposed to the client, normally and largely initiate consultation. There seems to be a conflict of opinion here, on the one hand ‘client consultation exists’ and on the other hand ‘no agreement exists in respect of the audit work meeting with client needs’ This is not surprising as the whole issue of client auditor expectation gap is well known. ‘If auditors cannot build a working relationship with the executive directors and management, they can never undertake a truly efficient and effective audit’. Fowle M. (1993)

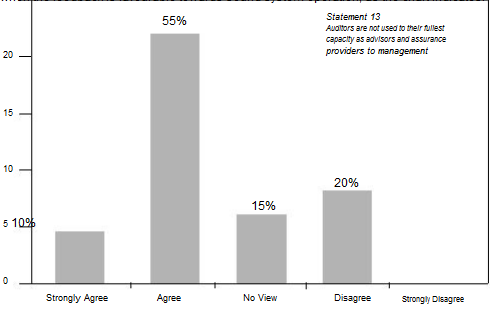

Auditors could be used to a greater extent as advisors and assurance providers

There seems to be agreement here with respect to the future role of auditing, corporate governance reports have helped in this respect in identifying the importance of sound internal control. The majority view indicates that audit assurance is important for managers when audit work is undertaken as there is disagreement to the statement that appreciation is only given 25 when the feedback is favourable towards sound system operation, as the chart indicates.

Figure 1: Local Government Expectations, Perceptions and Attitudes

Job satisfaction is derived from the audit work, 83% of the respondent’s derived satisfaction from their work.

This is a positive response in terms of individual satisfaction, yet conflicts with the earlier response in terms of uncertainty about the audit profile. When employees derive satisfaction from their work it generates a work ethos that filters throughout the department. The opposite of job satisfaction creates an uneasy feeling among the workforce that can lead to poor quality work, job insecurity, negative attitudes and conflict. When staff feel appreciated, feel part of an organisation they become well motivated, willing to learn and eager to progress on the ladder of promotion. All of which should ultimately help increase the internal audit profile.

Auditors generally consider their work as a valuable contribution to the organisation.

This statement had 90% agreement in terms of the contribution of audit being valuable to the organisation, not only does it reinforce the job satisfaction statement but also portrays the internal auditors own perception that audit is an important and valuable function within the organisation.

More in house training is required to keep up to date with current issues

Both staff and audit mangers agreed that there was a need for more staff training. One of the key drawbacks identified was that of financing and resource reallocation. It was generally felt by a number of respondents who added their own comments that the training required was that of a combination of audit theory reinforced by practical on the job training.

One initiative that the Chief Internal Auditors have developed in the South Wales is that of one or two day in house course provision that is shared between a number of authorities. These have also been supported by the NHS Trusts giving an opportunity for shared experiences across sectors and authorities, something that would otherwise perhaps not be given to some auditors. Examples of the issues covered on these of training include Systems Based Audit, Contract Audit and Best Value.

Audit consultancy training should be undertaken

In a similar vein to the above statement, recognising that more consultancy training is required means that the client (management) expectations and requirements are taken on board. The merits of undertaking consultancy training can assist the audit function in increasing its profile by offering a valuable service in addition to the services currently provided.

These last two statements in respect of the need for in-house training and consultancy training compliment a previous statement in respect of audit acting as assurance providers. They also support the literature review findings in terms of the changing attitudes towards better training and the continued professional development requirements of the ‘new’ auditor of the 21st century. ‘CPD is a way of optimising career opportunities by demonstrating and maintaining high levels of professional competence through continuous upgrading of skills and knowledge’. Lower, Marian. (2000). Other publications support this aspect of continued professional development or training per se. For example, ‘Be part of the new learning age. Your working environment must be a learning environment. Carry out a continuous skills audit of your knowledge and abilities. Plan to improve both. Master a critical understanding of the concepts and principles needed to understand how organisations should be managed and controlled today and tomorrow. This is essential for all the roles you provide as internal auditor’. Ridley, Professor Jeffrey, (2000)

‘To ensure that management obtains the maximum benefit from its audit resources, it is essential that all audit staff receive appropriate periodic training. Experience has shown that training will be most beneficial where it is directed at the needs of staff and when it is preceded by a proper appraisal system’. Williams, P. (2000)

‘As the pace of change accelerates, internal auditing must visualise and seize new opportunities to meet organisational needs. The new definition in intended to broaden the profession’s self image and encourage its full participation in the expanding market for internal audit services’. Krogstad et al (2000).

Internal Audit should play an important role in corporate governance.

This section of the questionnaire required respondents to identify their views on the role of internal audit within the context of corporate governance. As an aside to the actual survey the findings were revealing in terms of the increased presence of audit committees within Welsh Authorities as compared to a previous research exercise where audit committees were not a common feature (Davies and James 1999). The survey indicated that far more authorities now either had an audit committee or were in the process of establishing them as compared to the situation prior to local government reorganisation in Wales in 1996. The Turnbull report recognised the value of utilising internal audit in the corporate governance issue and the awareness of corporate governance and an indication that there is a willingness to be part of the corporate governance machine can only lead to benefits all round for the organisation. ‘If the audit committee agrees internal audit plans then this should contribute to the independence of internal audit and help ensure that members understand the role of internal audit more clearly. The audit committee’s approval of the audit plan should also encourage the perception of internal audit as an independent corporate review service. An internal audit service that is seen as helping to achieve the councils objectives as efficiently as possible will be more highly regarded than one that is merely considered to be identifying past mistakes and the occasional fraud’. Wynne. (1998).

The importance of internal audit in corporate governance in the public sector is reinforced by CIPFA’s views on looking towards the future of accountants and auditors. ‘As well as providing a decision support capability accountants and auditors will continue to play an increasing role in the analysis of risk; establishment and maintenance of effective systems of managerial and organisational control; the enforcement of corporate governance standards and the fulfilling of regulatory roles’. CIPFA (1997)

Control and Risk Self Assessment is not a concept that has been embraced by managers

Considering the amount information that has been written about the merits of CRSA, it has not been embraced within the Welsh authorities. According to Kennard, P (1996), Control Self Assessment ‘Broadens scope of audit, raises profile of internal audit, demonstrates added value, and expands audit appreciation of business risk’.

As for the profession, the Audit Commission considers internal audit as having a role to play in self-assessment. ‘Internal Audit’s role is to provide independent assurance to the management of an organisation on the adequacy and reliability of internal controls in order to promote the effective use of resources. As part of this role, internal audit may be able to contribute to self-assessment’. Audit Commission (1999)

The 1996 CIPFA audit conference survey on the issue of control self assessment revealed that although 76% of respondents declared themselves familiar with the technique, only 7% of organisations had actually implemented it and only 37% were considering doing so. It seems that four years on the situation has not changed a great deal in the Welsh local authorities.

CRSA may be well received in some sectors, but in this instance this does not seem to be the case. Due to the lack of CRSA uptake the use of internal audit as CRSA advisors has therefore not taken place. A number of respondents stated that ‘CRSA is an alien concept to mangers in my organisation’. The overall agreement was only 51%, while 41% of the respondents had no view at all in respect of the CRSA concept, which merely reinforces the fact that despite the merits claimed of CRSA it has yet to take hold within the Welsh local government arena.

The theory in this instance is not upheld by the practice in this sample. Although according to the comments a number of pilot schemes have been introduced in certain services and it may therefore be too early to assess how acceptable the exercise has been.

There is an agreement that audit should play a role in CRSA and a recognition that it would be beneficial without any detriment to audit activity. While CRSA would not be relevant to all services areas, it would allow audit to assume different and more challenging roles that would give a greater scope for providing ‘added value’. However there does seem to be reluctance on the part of management to embrace CRSA or at least it seems to be the case in the eyes of internal audit.

Figure 2: Local Government Control Risk Self Assessment

IT recognised as an audit tool

Whilst the use of IT as an audit tool is recognised, there is a feeling amongst the respondents that there is still considerable opportunity to develop the use of IT within audit, especially in developing and designing specialist audit software.

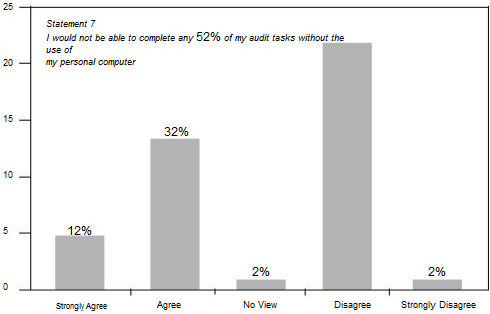

Conflict exists as to whether audit tasks could be completed with or without the computer.

The respondents were unclear here as to the agreement towards using the computer for audit work. There were those who felt that audit work could still be undertaken even without the computer, while other relied heavily on their PC to complete their work.

Danielle Stewart of Warren Stewart, London argues that ‘an auditor could not comply with the Auditing Practices Board’s recently produced draft standard unless the audit was IT-based’. Williams, P. (2000). ‘It is a fact however that for many private and public sector organisations, there is now a complete dependence on IT services. One of the most critical issues they now face is how to manage, control and direct IT- especially given the difficulties of finding the right, qualified people.’ Thomas, G (2000).

The survey agreed that the use of IT and computer audit software saves a great deal of staff time. However the existence of in-house designed software packages is not a common feature. The agreement to time saving is an obvious one, although it could be interpreted that if there is no comparison based on time efficiency where IT is not available this response is merely based on assumptions. Designing in-house software might reflect a number of issues such as lack of time, skills, knowledge and confidence of auditors in designing their own audit software packages.

IT is a good tool for analytical review.

‘Most auditors would probably consider the use of analytical review is complimentary to testing as opposed to being a substitute’, this is based on the informal feedback received during the preliminary interviews undertaken prior to the distribution of the questionnaire. As an aside to the IT in audit this might be the appropriate place to comment on the need to ensure adequate training exists to ensure that the usefulness of IT is maximised. This is reinforced by the bar chart that indicates that there is agreement to the assumption that lack of IT knowledge is a drawback to effective auditing. However based on this research there is no real correlation between the whether IT knowledge and effective auditing are related.

Figure 3: Local Government IT in Audit

IT recognised as an audit tool and is supported by the majority of respondents; this is endorsed by the disagreement to the statement that IT as an audit tool is overrated.

There exists a conflict between the agreement and disagreement as to whether audit tasks could be completed with or without the computer. The use of IT is however recognised by some as allowing certain audit tasks to be completed more accurately and quicker than normal exercises. The following bar charts illustrates that auditors still have sufficient confidence in their audit skills to work without the assistance of a computer.

54% disagreed and therefore do not consider the computer an item that they must rely upon to complete their audit tasks.

Audit to act as a consultancy rather than just a checker of controls

Here again the value-added role of the audit is reaffirmed by the recognition that the audit of today and tomorrow is changing to meet user demand.

This reiterates the previous assertions regarding auditors as assurance providers, and is obviously an issue that exists and one that the auditors accept.

Routine audits are not a waste of time.

Although, surprisingly, 25% of the respondents agreed that routine audits were a waste of time. Routine audits are not regarded as a waste of time because the value of individual audits should be reviewed as part of the audit management planning process. Therefore all audits included in the audit plan should be of value.

‘An appraisal function – The internal auditor’s job is to appraise the activity of others, not to perform a specific part of data processing. For example, a person who spent his time checking employee expense claims is not performing an internal audit function. But an employee who spent some time reviewing the system for checking employee expense claims may well be performing an internal audit function’. Millichamp (1996) p.493.

Traditional ticking and vouching is still important.

Audit has evolved due to the development of techniques that have built on past knowledge and experience and as such the audit itself has changes without becoming a ‘new’ service. For this reason everything learnt in the past is still important although not placed in such a predominant position. The bar chart below confirms the importance of still maintaining the ticking and vouching approach.

Figure 4: Local Government Audit Approach

Audit debriefing is an integral part of the audit function.

60% agreed with the debriefing concept, 24% had no opinion and 16% disagreed. Based on the literature review and the increased awareness for communication in the audit team it was surprising that the response to this was only 60% and that 24% had no opinion.

Risk based approach is favoured as an effective audit approach

Recognition of the new age approach to audit as one that has to take on board the realisation that Systems Based Audit is gradually being reinforced with the Risk Based Approach.

SBA plays is an important role in audit work

The systems based approach is still regarded as a sound audit approach to undertaking the audit. Local government sector organisations with their bureaucratic control based working methods lend themselves to this approach.

The annual audit plan should not be the sole responsibility of the Chief Internal Auditor

The responses seem to indicate here that certain internal auditors feel that they may be able to contribute to the annual audit planning activity. On the other hand there were instances where the Chief Internal Auditor felt that there was scope to include staff in order to generate a sense of ownership to the tasks, it also acts as a learning mechanism for those climbing the ladder of promotion.

The statement asked the respondents to consider whether there was team involvement in the audit planning. The replies indicated a clear disagreement, when read in conjunction with the statement regarding the audit plan being the sole responsibility of the Chief Internal Auditor it seems that audit team members feel that they have a contribution to make towards the annual plan. The bar chart below gives the level of agreement and also indicates who the respondents were in terms of auditor grade.

Audit reports tend to be proactive.

64% of the respondents indicated that the audit reports within their organisations were proactive rather than reactive. This might support the initial response where the consultancy and advisory role is now becoming more of a feature of the audit

Figure 5: Local Government Audit Approach

In conclusion, internal audit seems to be having a facelift

In the public sector an increased emphasis on corporate governance and public reporting has placed the Internal Auditor into a more focused position. Organisations are increasingly looking to their Internal Auditors to give guidance and advice at all levels of management. By being tuned into management philosophy and direction, internal audit can provide a pro-active value added service. An advisory role provides senior management with the added support to decision making issues and problems that ensure the achievement of organisational goals. Bonham (2000) refers to the auditor as ‘no longer merely the basic compliance auditor but a business adviser and coach that is to be viewed as a valued service to the organisation’.

The traditional features of audit meant that auditees had no choice in the audit, few treasurers were concerned about setting terms of reference, and so audit set its own work programme. Audit presence was regarded as deterrent, routine audits were carried out with monotonous regularity and with no flair. Audit reports were rarely to the client, merely to the treasurer, while the audit was mainly that of voucher bashing. When a weakness was found it was plugged with another control irrespective of the inflexibility or lack of effectiveness. Audit work finished at five irrespective of the task while there was a lack of accountability in terms of what the audit did. The modern and current approach to audit however takes on board a more proactive approach that is of benefit to management. Corporate agreed strategies, audit plans often agreed with both the client, and audit committee as well as levels of materiality taken into account when undertaking the audit work. The Chief Internal Auditor is now reporting in his/her own right to the client and in some authorities the Audit Committee. The introduction of Systems based and Risk based audit with scientific testing as well as computer software packages for Computer assisted audit techniques. Internal audit is now becoming accountable for its work to management. By means of agreed performance indicators along with all the other services. This has helped assure an internal audit that displays flexibility in terms of working hours, with clock-watching becoming a thing of past. Audit advice and involvement in system design and implementation is leading to a more proactive approach and drawing on audit expertise. Audit no longer regarded as the dumping ground for ineffective staff; career and promotion prospects now attached to the audit department.

The findings of the survey on the expectations, perceptions and attitudes of public sector internal audit department go some of the way to illustrate these changes in audit activity.

Changed perceptions

As a result, the audit image has certainly increased during the past 10 years: This can be verified by the review undertaken by CIPFA during the 1980’s in ‘The View of the client towards Internal Audit’, The response came up with four positive points by management regarding internal audit.

Most mangers accept that internal audit provides a positive contribution to the department

Most managers consider that internal audit understands the real issues confronting them and their departments.

Most mangers are happy to discuss technical issues with their internal auditors and have confidence in internal auditor’s ability to do this.

There is an increasing need for internal auditors as communications and information technology moves into the twenty-first century.

Minimum audit service to advisor and assurance providers

There has been a progression from the traditional minimum audit service as required by statute to the more corporate approach of business assurance provider. This concept of business advisor and assurance providers falls in line with what current publications and the results of the survey indicate. The change in audit can be summarised under two headings that of ‘barriers’ and ‘enablers’, attached as Appendix 2. The barriers to sound audit provision include a lack of management involvement, poor skills levels, failure of staff to understand the organisational goals, poor communication and a lack of capacity and ability to change. The enablers on the other hand include positive aspects of motivation; team approach, quality audit work and high performance, focused approach and a leading edge in terms of audit methodology and techniques.

The results of the questionnaire survey indicate how the face of internal audit has changed, mainly in terms of the auditor attitudes and perceptions, thereby overcoming some of the barriers and embracing the enablers. The internal auditor has also recognised that these changes have affected both the work environment and the audit perceptions form both the auditor and the management.

There are still, however, a number of hurdles that the auditor will need to overcome if the audit function is to match that of the textbook internal audit function. The classic case of theory and practice not being truly compatible.

One aspect is certain, the audit of the last century is definitely changing, and it could soon be the case that the audit of the 1990’s could quickly come to be viewed as quaint and old-fashioned.

The ‘new’ style auditor

From the key issues that were identified, a key point arises from the survey, and that is the need to invest in training for the auditor of the 21st century. If the ‘new ‘ auditor is to cope with the concepts of assurance, corporate governance and information technology more funds need to be invested into continued professional development, by means of in-house training, academic and professional courses. The internal auditor needs to feel confident that he/she has the know-how, skills and confidence to meet the expectations of management and audit managers. This enhances the stature of the internal auditor in the eyes of those who are being auditor or in receipt of audit advice and consultation.

Recognition for more in house training to keep up to date with current audit issues and more emphasis should be placed on training for audit consultancy, indicates that both the Chief Officers and lower grade auditors acknowledge that audit is a dynamic and forward thinking profession. This should also bode well for in-house training programmes to be established that will become an aspect of auditor expectation in that they will form part of normal audit training.

It was a surprising revelation that CRSA (Control and Risk Self Assessment) was not a common feature. To discover that the statement ‘CRSA is an alien concept to the managers of my organisation’ was a disappointment. There might be a case here for audit departments to reconsider the CRSA usefulness and enlighten management of its benefits.

.

The lack of IT and computer software knowledge is a drawback to effective auditing in the department is linked to the training aspect of auditors. IT is an ever changing environment and keeping up to date with IT developments cannot be left entirely to hand-on practical experience, there is a need to ensure a cascading of information and appropriate training to keep abreast of events.

Finally ‘I consider my work as an auditor as valuable contribution to the organisation’ must be a very positive message at the future of the internal auditor in the 21st century.

90

Journal of Finance and Management in Public Services. Volume 1 Summer 2001

0 Comments:

Subscribe to:

Posting Komentar (Atom)